Possible Reasons Behind Highly Priced Amazon Stocks

Table of Contents

Introduction to the Article

If you are new to the Stock marketshares, then there would be many doubts about your kind. This is quite common because the current state of the Stock market is confusing due to many factors. Unexpected growthsfalls have been partparcel of 2020.

We know that the urge to earn money through the stock market is high. For instance, Amazon is the best performing E-commerce company in the world. In addition to that, Amazon is the second leading performing stock market overall after Apple.

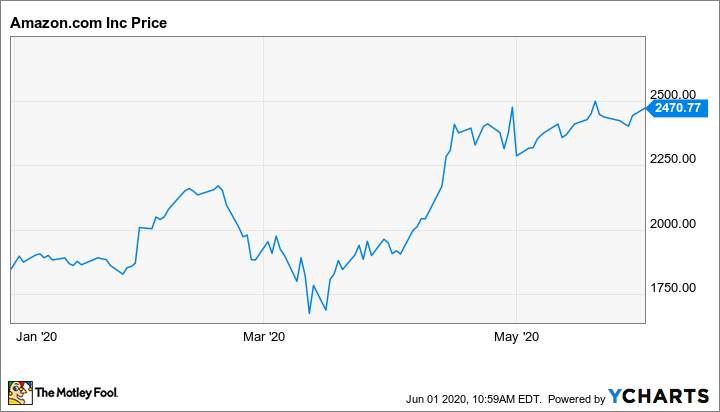

NASDAQ: AMZN at https://www.webull.com/quote/nasdaq-amzn clearly states that Amazon is nowhere near falling down for months now. Recently, Amazon crossed the margin of $1 trillionbecame the first to ever do it as an E-commerce Company.

Market stock rates of Amazon are highly-priced,investors are keen to know the possible reasons. In this article, we will take a look at some major reasons behind this high price of Amazon stocks in the market.

Possible reasons are as follows:-

Less Outstanding Stocks

Amazon takes small factors into considerationsdraws major decisions on them. Outstanding the stocks are nothing but the amount of stock which are left or unsold stocks. You should know that the price of a stock is determined before considering some factors. Currently, Amazon has the second-largest stock market area after Apple. Initially, the stocks which were purchased were not costly. Due to less amount of unsold stock present with Amazon, the cost of those stocks are increased by Amazon. Therefore, the availability of less outstanding stocks is a major factor for high prices market stock rates.

Progressive PoliciesReturns

A company should be customer friendlyalso Investor friendly. Amazon is a retail selling unit, has a positive word of mouth. These words are also applicable in various fields where Amazon is entering. Amazon Prime is a service provided to buyers who pay extra for getting prime services. This is also a streaming platform-wide to which the market stock rates of Amazon are also on the rise. The returns which are entities to the stockholders is commendable. Existing Investors are joined at returns from Amazon due to its blooming period in the market.

$1 Trillion Mark

Amazon became the first e-commerce company to get their average market stock rate on 1 trillion in 2018. Being the first to ever do it, investors were amazed by seeing the growth. The continuous growth of Amazon’s stock rates also boosted the price of its stock. This eventually made it easier for Amazon to increase the rate of its market stocks due to its high prestige. You can check more information such as balance sheet at https://www.webull.com/balance-sheet/nasdaq-amzn.

Disclaimer: The analysis information is for reference onlydoes not constitute an investment recommendation.